Beware the Internet of Things

In case you missed it, the technology world is all about “the next big thing.” We are all breathlessly awaiting the next technology pronouncement that will — pundits like me say — be essential to your enterprise or to your larger organization. And it goes without saying that anyone who doesn’t buy in to said pronouncement will be left whimpering in the proverbial dust by their far more tech-savvy competitors.

Let us then consider one of the hottest new technology concepts—and ruminate on how this concept will affect the insurance industry. Behold, the Internet of Things (IoT)! According to Techopedia, “The Internet of Things (IoT) is a computing concept that describes a future where everyday physical objects will be connected to the Internet and be able to identify themselves to other devices. The term is closely identified with RFID as the method of communication, although it also may include other sensor technologies, wireless technologies or QR codes.”

Why is this so important? “The IoT is significant because an object that can represent itself digitally becomes something greater than the object by itself,” says Techopedia. “No longer does the object relate just to you, but is now connected to surrounding objects and database data. When many objects act in unison, they are known as having ‘ambient intelligence.’”

Admittedly, this still sounds rather academic and esoteric, but the people at Cisco make a very telling comment on their web site. According to Cisco, “The Internet of Things (IoT) is the network of physical objects accessed through the Internet, as defined by technology analysts and visionaries. These objects contain embedded technology to interact with internal states or the external environment. In other words, when objects can sense and communicate, it changes how and where decisions are made, and who makes them.” (Italics mine)

Now we begin to see the importance of this technology in general and for the insurance sector in particular. Anything that impacts on our decision-making process is certainly significant. But just what kinds of “objects” are we talking about?

“The IoT is connecting new places–such as manufacturing floors, energy grids, healthcare facilities, and transportation systems–to the Internet,” Cisco explains.

“When an object can represent itself digitally, it can be controlled from anywhere. This connectivity means more data, gathered from more places, with more ways to increase efficiency and improve safety and security.”

It also means many more ways for criminals to interfere with operations and/or steal confidential information. It’s one thing to have the appliances in our homes communicating with each other to automatically provide appropriate lighting, temperature control, food preparation, video monitoring of our premises, etc., but it is quite another to have, say, an entire city’s power grid exposed to multiple points of hacking. And what about all that confidential data that sits on healthcare systems?

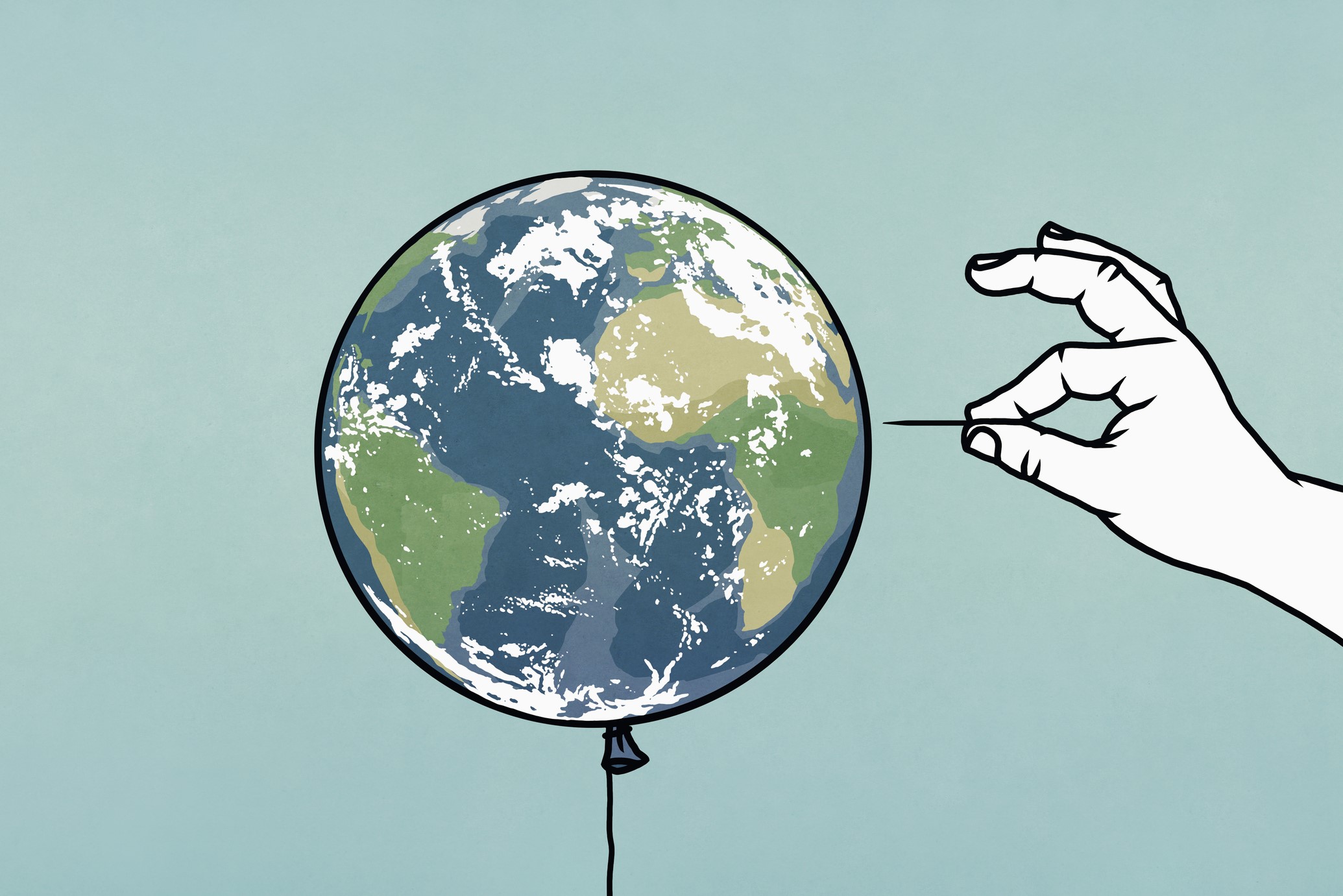

The IoT is clearly a two-edged sword. It will (or should) allow far more automation of manufacturing and transportation systems, which should result in higher efficiency and (insurers take note) greater safety. Unfortunately, every “object” or device now becomes a point of access—offering an opportunity for mischief, or perhaps more serious crime. In a strange, antediluvian way, the very fact that most of today’s electronic devices are not connected through the Internet provides a layer of data security that can and will be lost as literally anything that runs on electric power becomes an Internet object.

Beware the IoT.