Brokers

Brokers See P&C Rate Increases Slowing

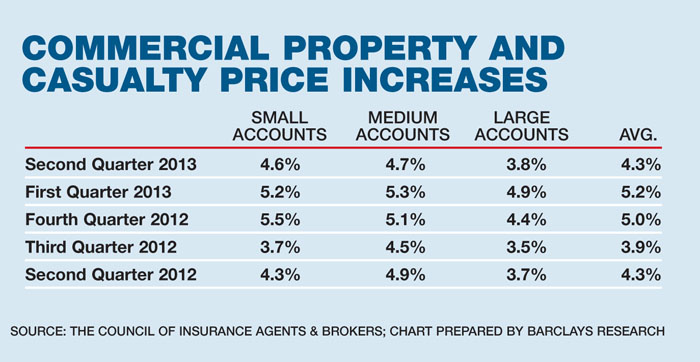

Commercial property and casualty (P&C) pricing continued to move higher, but the growth rate slowed in the second quarter, according to the Council of Insurance Agents & Brokers (CIAB) quarterly Commercial P&C Market Index Survey.

On average, pricing rose at a rate of 4.3 percent, compared to 5.2 percent in the first quarter of 2013. Small and medium account pricing continued to rise more than pricing for large accounts.

“Clearly things are flattening out,” said Coletta Kemper, CIAB’s vice president of industry affairs. “The sector has been profitable and underwriters have been able to build back some reserve and surplus. Reinsurance has also done well, and that has kept costs down.”

Council members are market leaders who annually place 85 percent of U.S. commercial property/casualty insurance premiums and administer billions of dollars in employee benefits accounts.

Council members are market leaders who annually place 85 percent of U.S. commercial property/casualty insurance premiums and administer billions of dollars in employee benefits accounts.

“If profitability continues as it has been, if losses remain manageable and reinsurance remains affordable, then it would be reasonable to assume that current slowing trends in pricing will also continue,” Kemper said. CIAB found that critical areas continued to be property and workers’ compensation.

“Workers’ compensation has been a problem area for several quarters,” said Kemper. “That has been a very tough line.”

Workers’ compensation was a tough sell, particularly where loss experience was poor.

The second quarter survey also showed that insurers were still feeling the sting of Superstorm Sandy, and that insurers were looking carefully at any Cat-prone property exposure on the coast or inland.

On a more positive note, she added that “the Sandy effect is starting to wear off a bit. That could be because the exposures have already been factored into property coverage, or just because carriers have gotten more comfortable with their positions.”

Demand for insurance appeared to hold steady in the second quarter, according to CIAB, an indication that the economy is slowly recovering.

“Workers’ compensation has been a problem area for several quarters.That has been a very tough line.”

— Coletta Kemper, vice president, industry affairs, CIAB

CIAB also found that brokers across the country reported that insurers were using more wind and hail deductibles, adding that carriers pulled back on terms and conditions, and lowered limits and cover for exposures, such as storm surge, flood and off-site power, among others.

James Blinn, executive vice president of Adivsen Ltd., said that, broadly speaking, “rates had been rising at an accelerating pace starting in the fourth quarter of 2011 through the first quarter of this year.”

He said that research done by his firm on its own, as well as on behalf of the Risk and Insurance Management Society, indicated that the macroeconomics behind P&C increases seemed viable, “but the rate of increase was not sustainable.”

“If you look at earnings and at Cat losses, there was no real driver for that acceleration to continue.”

Blinn stressed that within those broad trends there was a lot of variation.

“Mid-market buyers are experiencing more rapid growth in pricing than larger markets. From a buyer’s perspective, markets with more competition have not been rising as fast,” he said.

“From a seller’s perspective, finding niche markets clearly has an advantage.”

Advisen collects information annually on $10 billion in premium transactions.

In property capacity, said David Finnis, national property practice leader for Willis North America, “most shared and layered accounts are over-subscribed at renewal due to the oversupply of capacity in the market.”

“This trend will likely be furthered by the arrival of new capacity.

“In reinsurance, insurers renewing their treaties in 2013 were seeing decreases of 10 to 15 percent in advance of July renewals.”

Finnis also said insurers renewing separate reinsurance programs for Florida Cat risks were seeing decreases of 15 percent to 20 percent due to the low level of losses in Florida since 2005.

Finnis said the first half of 2013 was characterized by light loss activity with the exception of the EF5 Moore, Okla., tornado.