Insurance Industry

Disrupting Insurance Distribution

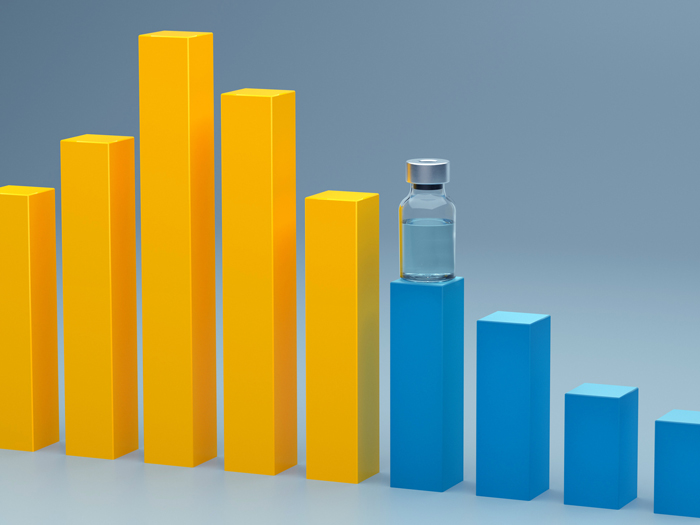

As more insurance distribution channels are being created, the potential disruption of the ordinary course of business for underwriters and brokers increases.

One of those channels, although details are hazy, involves Overstock.com Inc., a Utah-based e-commerce site that survived the dot-com bust by selling dying Internet companies’ inventories.

Since April 2014, Overstock.com has sold insurance, including auto, property, liability and workers’ comp for businesses, through an exchange where consumers receive live quotes, pick which the coverage they like, and then have a policy bound for them.

“Overstock’s mission is to offer high-quality products at low prices in order to save people money, and the launch of our insurance tab fits this mission beautifully,” Dave Nielsen, Overstock.com’s senior vice president, said in an email.

Or as the slogan on the Overstock insurance site says, “We Do the Work, You Do the Saving.”

But who is really doing the work … a.k.a., the underwriting?

Apparently, the underwriters’ names had been confidential, but when we asked Nielsen, he shared some of them: 21st Century, Progressive, Safeco and American Strategic (ASI).

Overstock.com is “seeing good traffic” on the site, Nielsen said, and he’s expecting to “see [sales] continually increasing month over month” as the company adds more products.

The logistics of claims and other policy-servicing depends on the carrier, Nielsen added. Overstock services some accounts in-house; others it transfers directly to carriers. But no matter what, policyholders contact Overstock first.

Most of the insureds probably care little about the identify of the underwriters, said Denise Garth, partner and chief digital officer at consultancy Strategy Meets Action (SMA).

As far as the insurance buyer goes, they’re a customer of Overstock.com.

“[Overstock is] definitely the channel where it’s been sold, and it’s the channel where the customer is going to go to for service,” Garth said.

And it’s just one channel of many it seems that are on the verge of disrupting well-tread insurance distribution networks.

In particular, according to a report from London-based market risk and consulting firm Finaccord, as many as 281 retail brands around the world are selling insurance, up from 232 retailers in 2010.

Global names like Walmart, Tesco, Marks & Spencer, and Carrefour are “leveraging” their brands and huge customer bases to sell mainstream insurance products, said Finaccord Director Alan Leach.

“They can supplement the thin profit margin that they can earn from their core business by selling financial services,” Leach said.

They wield data they already collect on their customers to empower cross-selling. If they know which of their customers buy pet food, they know which of their customers to ma rket pet insurance to.

rket pet insurance to.

At this point, however, this trend of retailers selling insurance is “not so much” in the United States, Leach said, and in many cases, they’re selling personal lines products to consumers. (Walmart does offer an auto-insurance exchange in 19 U.S. states.)

Impact on Industry

But retailers are just one group the traditional insurance world must confront.

Some observers, like Garth, argue that this trend doesn’t just put the insurance distribution process at stake, but affects the industry’s business model as a whole.

Some of the savviest, brawniest, data-driven companies in the world are coming. Alibaba, of the recent record-breaking IPO, launched an online insurance platform in 2013 called Leyebao, aimed at Alibaba’s online store owners and their employees. Google forayed into the insurance space in the U.K. in 2012, with a car insurance comparison tool.

They’re coming because consumers apparently want them to.

“Competition in the insurance industry could quickly intensify as consumers become open to buying insurance not only from traditional competitors such as banks but also from Internet giants.” — Michael Lyman, global managing director, insurance industry practice, Accenture

In its report on this new competitive landscape, SMA cited an Accenture study that found that two-thirds of respondents would consider buying insurance from organizations other than insurers. About 23 percent said it could be Google or Amazon; 14 percent said retailers.

“Competition in the insurance industry could quickly intensify as consumers become open to buying insurance not only from traditional competitors such as banks but also from Internet giants,” said Michael Lyman, global managing director for management consulting within Accenture’s insurance industry practice, when he announced the Feb. 2014 research.

The disruption will not be as black and white as an Alibaba launching an insurance company or Walmart taking jobs away from Main Street agents. The invaders seem to care less about the means than the end result.

“They want to own a customer for a lifetime,” Garth said.

Their success at that could leave insurers as mere “manufacturers” of insurance products, and agents and brokers as mere customer service representatives, for the companies that will own consumer loyalty and lifetime customer value.