Innovation

A Renewable Impulse

Every cynic that derides the promise of renewable energy should have a chat with the Swiss pilot, businessman and adventurer Andre Borschberg.

Borschberg, along with his partner and countryman Bertrand Piccard, successfully piloted the first solar plane to fly across the United States in the spring and early summer of 2013. And insurance was there to help make it happen.

Swiss Re Corporate Solutions provided hull insurance, aircraft liability and crew personal accident coverage for the Solar Impulse, a solar-powered plane conceived, engineered and built in Switzerland.

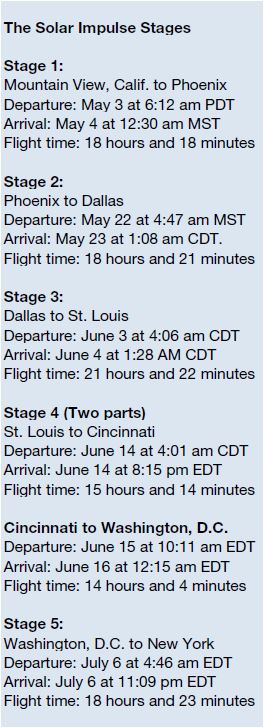

After shorter flights in Europe and North Africa, the entirely solar-powered  plane and its pilots took on the adventure of flying from the west coast to the east coast of the United States in five stages.

plane and its pilots took on the adventure of flying from the west coast to the east coast of the United States in five stages.

The plane, which has two propellers and is self-powered on takeoff, left Mountain View, Calif., on May 3. After stops in Phoenix, Dallas, St. Louis, Cincinnati and Washington, D.C., Solar Impulse arrived in New York on July 6, completing its adventure across America.

The ultimate goal of the project, a primary premise of which is to realize the promise of renewable energy, is an around-the-world flight sometime in 2015.

The insured value of the plane is some $9.17 million, according to its Zurich-based insurer. The total value of the project to date is some $112 million.

HB-SIA, the prototype that is crossing the United States, was not built to fly around the world, but data collected from the flight will be used to construct HB-SIB, the prototype that will be built for the global voyage.

There was no small amount of pressure on Borschberg and Piccard as they took on this cross-country trip. Investments from as many as 80 companies went into the plane, which has a 208-foot-wide wingspan, and yet at 3,527 pounds, weighs only as much as the average car.

The lightness of the plane and its great width require a soft touch at the controls. The pilots must act with deliberation and under no circumstances can they overcorrect.

One of the beauties of recording modern adventures is that, in many cases, a journalist can communicate with the explorer in real time. So it was on June 13, that Risk & Insurance® through its relationship with Swiss Re, was given the opportunity to connect by telephone via satellite with Borschberg as he flew the Solar Impulse from St. Louis to Cincinnati.

“What is interesting about the plane is that you discover a whole new way of flying,” said Borschberg, who despite long hours at the controls of the single-passenger plane sounded relaxed and happy.

The plane is equipped with four brushless motors and is powered by more than 11,500 solar cells on its wingspan and horizontal stabilizer. It cruises at around 40 mph, which gives the pilots plenty of time for reflection.

“This is an airplane where duration is not a problem,” Borschberg said. “Of course, we fly at low speed but we can fly day and night; there are no limits,” he said.

“So time is not an issue anymore and you can enjoy what you do. We are not in a hurry. A day like today is truly an experience. It is a possibility to enjoy each moment and to be present in each moment,” he said.

As he flew on June 13, Borschberg enjoyed good flying conditions, with relatively clear skies and manageable winds. One of the purposes of the United States flight was to test the plane and its support team in different weather conditions.

Earlier, as the team prepared to fly to St. Louis, the convergence of an increasingly volatile climate driven by a warming planet collided with the ambitions of this Swiss project dedicated to the promise of renewable energy.

On May 31, the airplane hangar in St. Louis that had been tapped to serve as the temporary home of HB-SIA was damaged by a tornado. The Solar Impulse team adjusted, inflating a temporary hangar that stored the plane snugly.

“That was one of the goals of the flight here across America … to be exposed to different weather systems, different conditions, from the ones that we experienced in Europe and North Africa already, so that was part of the training,” Borschberg said.

The team behind this record-breaking flight is an impressive and well-qualified one. Borschberg served as a Swiss fighter pilot for more than 20 years. In addition, he earned a Master’s in Management Science from the Sloan School at

MIT and has been involved in numerous aviation start-ups.

Piccard, who comes from a family of scientists and adventurers, gained fame as the winner of the Chrysler Challenge, the first transatlantic balloon race in 1992. He built on that feat by being the first person to pilot a balloon around the world in 1999. Piccard, chairman of the Solar Impulse project, began thinking about a solar-powered plane in 2003, but he needed a lot of help to see his dream realized.

Major corporate partners on the project are Frankfurt, Germany-based Deutsche Bank, the Belgian chemical company Solvay S.A., Swiss watchmaker Omega S.A. and the Swiss elevator maker Schindler.

Additional corporate partners include Swiss Re, Bayer, Swisscom and Altran, but there are more than 80 companies associated with the project. That’s in addition to a team of scientists and engineers based at the École Polytechnique Fédérale de Lausanne in Switzerland.

Apart from the tornado that trounced the hangar in St. Louis, the trip across the United States was an unqualified success.

“Touch wood, cross my fingers but the airplane is doing great,” Borschberg said.

“The solar technology is something which is fully reliable. You cannot wear this out … it lasts,” he said.

“Electric motors also have few moving parts, so that is a big, big advantage. They function at low temperatures, so you don’t have the thermal shock that you have with other technologies.”

In its brief life, Solar Impulse already possesses several aeronautical records for a solar plane, including an absolute height of 30,300 feet and duration of flight at 26 hours, 10 minutes and 19 seconds.

Both Borschberg and Piccard are well-seasoned pilots, which is an advantage because the physical demands of flying Solar Impulse are considerable.

The plane can only carry one person, so there is no one to relieve the pilot, even as he stays at the controls for 24 hours or more at a time.

For Borschberg, the sheer joy, not only of flying itself but of being a pilot on this particular project are more than enough to carry him along.

“Of course Bertrand and myself, we are really passionate about the work we are doing. We are passionate about flying and when you truly like what you are doing, you have a different kind of energy,” he said.

“Second, we are carried by the potential of this airplane and also by the ideal that is around that,” he said.

“I think the other part, of course, is that flying is a wonderful way to look at the earth and see the beauty of it. And so when you fly, you are captivated by that.

“It can be by day, it can be by night. It can be at sunset, it can be at sunrise, so all of this makes the trip truly memorable.”