Emerging Markets

Finding the Next Frontier

Brazil, Russia, India, China and South Africa (BRICS) are readily recognized as emerging markets for the insurance industry, accounting for more than half of emerging market output, according to a recent Swiss Re sigma study, “Insuring the frontier markets.” But these are larger, more established countries with stronger economies. What about the next wave of opportunity for insurers looking to take advantage of a smaller country’s growth potential?

Swiss Re’s study looked beyond BRICS for the next wave of “frontier” markets, loosely defined as “less established insurance markets in smaller emerging economies with promising growth outlook.”

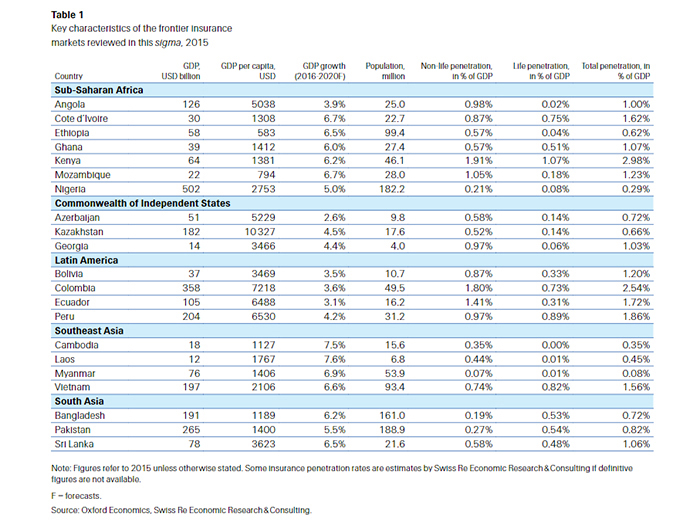

The study identified five regions consisting of 21 frontier markets: Sub Saharan Africa (Angola, Cote d’Ivoire, Mozambique, Nigeria, Kenya, Ghana, and Ethiopia); the Commonwealth of Independent States (Azerbaijan, Kazakhstan and Georgia); Latin America (Bolivia, Colombia, Ecuador and Peru); Southeast Asia (Cambodia, Vietnam, Laos and Myanmar) and South Asia (Bangladesh, Pakistan and Sri Lanka).

The study identified five regions consisting of 21 frontier markets: Sub Saharan Africa (Angola, Cote d’Ivoire, Mozambique, Nigeria, Kenya, Ghana, and Ethiopia); the Commonwealth of Independent States (Azerbaijan, Kazakhstan and Georgia); Latin America (Bolivia, Colombia, Ecuador and Peru); Southeast Asia (Cambodia, Vietnam, Laos and Myanmar) and South Asia (Bangladesh, Pakistan and Sri Lanka).

These markets are also characterized by low insurance penetration rates, which offers insurers “significant catch-up potential” as their economies expand and insurance becomes more vital to that process.

“Right now, the culture in these countries is such that most people do not consider insurance because they must first meet their basic needs: food, housing, etc.,” said Arend Kulenkampff, senior economist with Swiss Re and a study author. “But as the economic situation improves, individuals and businesses will spend more on insurance to protect what they’ve gained.”

Regional Breakdown

Sub Saharan frontier markets grew by an average of 6.4 percent per year from 2000 to 2014. Of the Sub Saharan countries, Nigeria has the largest economy at $520 billion, followed by Angola at $130 billion.

A growing public awareness of the importance and value of insurance has led to more efforts to regulate the industry, which would stabilize it and support its growth. Both nations also enjoy a robust oil industry, although falling oil prices could jeopardize their economic stability at least over the short term.

“Some of these countries are resource dependent, so their economic fortunes are tied to commodities prices,” said Bob Hartwig, president of the Insurance Information Institute. “The ability to grow in a place like Mozambique or Nigeria will be tied to fluctuations in those prices.”

Additional challenges in Nigeria include terrorism and a corrupt government, Hartwig said. “That’s a good example of a country where you really have to understand the environment to be able to operate effectively and safely.”

The Commonwealth of Independent States countries also rely heavily on oil exports for revenue and have experienced slowed growth since the slump in oil prices. To be viable long-term markets, they will have to diversify their economies, the study said.

They have also, however, made legislative efforts to make certain types of insurance compulsory, such as medical coverage. Azerbaijan has probably made the most headway in this arena, mandating workers’ compensation and auto coverage as well.

In Latin America, Brazil attracts the most attention as an emerging insurance and reinsurance market, but the smaller frontier markets are projected to grow by 3 to 3.3 percent in 2016.

Insurers looking to enter these markets will face considerable constraints related to political instability, low income levels, and a prohibition on foreign investment that, despite ending in 1987, has caused this cluster of countries to lag behind other markets.

There have been reforms, however, to encourage more foreign investment.

“The influx of foreign capital in this region is promising; Colombia especially has seen a sizable growth of investment, and it will be necessary to keep the growing economy healthy,” Kulenkampff said.

In Southeast Asia, Vietnam represents the largest of the four frontier markets, accounting for 71 percent of the region’s total GDP in 2015.

“Vietnam is a dynamic economy that’s growing rapidly,” Hartwig said. “They seem open to foreign investment and have an increasingly popular manufacturing hub and tourism center. But there are a lot of issues with their relationship with China, so you have to be concerned about conflict there.”

Cambodia also shows promise if it can successfully resolve its internal political turmoil.

Indeed, political stability will be the primary factor determining the longevity of these markets.

In Pakistan, for example, political turbulence and violence undermine the potential that any economic growth might hold for insurers.

Sri Lanka, on the other hand, “has benefited from the peace dividend and political stability since the end of the civil war in 2009. The economy achieved average annual growth of 7.3 percent between 2010 and 2014,” the study said.

Gaining a Foothold

“We’re well beyond the stage of just keeping an eye on these markets. They are growing much more quickly than markets in North America, Western Europe or Japan,” Hartwig said.

Entering the markets, though, will require a long-term strategy and plenty of investigative research concerning their socioeconomic environments as well as what products are needed. Foreign insurers will need to partner with or acquire a local carrier to develop sales and distribution platforms within local laws and regulations.

“These frontier markets are not for everyone. Some insurers will enter them and they will fail, either because they don’t understand the market or because conditions on the ground will become too volatile.” — Bob Hartwig, president, I.I.I.

One strategy suggested by the study is the distribution of “micro insurance” — essentially low-limit, short-term policies that are affordable for the low-income population. Marketing and selling coverage through mobile technology also proves an efficient way to reach remote customers and make transactions easier.

No matter how insurers choose to place their stake in these markets, patience will be key to an eventual payoff. Initially, any premium dollars collected from these markets will have no significant contribution to profit.

“These frontier markets are not for everyone,” Hartwig said. “Some insurers will enter them and they will fail, either because they don’t understand the market or because conditions on the ground will become too volatile.”

Though not included in the Swiss Re study, Hartwig also suggested Cuba as an emerging market, given its proximity to the U.S. and the thawing of political tensions, as well as its vulnerability to natural disasters like hurricanes.