2014 Power Broker

Winning the Benefits Battle

Employees at the national headquarters of the American Legion Auxiliary liked their health insurance plan, but they weren’t able to keep it.

Like five million other plans, their health plan was cancelled last year, leaving the Indianapolis-based veterans services organization scrambling to cover its employees.

“Anthem Blue Cross Blue Shield did away with all of their small group policies and made new ones,” said Donna Parrott, HR director of the nonprofit organization.

Fortunately for the group, they had Kevin Wiskus, an executive vice president at the Hays Cos., to protect their interests.

Wiskus, a 2014 Power Broker® winner in the Employee Benefits category, was able to find a plan that — ever mindful of the nonprofit organization’s fiscal constraints — reduced the organization’s health plan costs by about 10 percent, Parrott said.

To see all 2014 Power Broker winners, click here.

Wiskus was an area vice president at Gallagher Benefit Services when he put together a benefits solution for the American Legion Auxiliary. And, said Parrott, “it was about 16 percent cheaper than what Anthem recommended.”

“He goes above and beyond,” she said. “We are a small group but he doesn’t treat us as a small group. You would think we were his only client the way we get that personal touch.”

Going above and beyond is emblematic of Power Broker® winners in 2014 — and not just those focused on employee benefits plans.

But while Superstorm Sandy focused attention last year on the Power Brokers specializing in property, this year, it’s the Affordable Care Act that is taking center stage.

Employee benefits consultants and brokers have had to find ways to dig through 11,000 pages of regulations — regulations that have been changed at the last minute — and excavate the necessary information to protect their clients.

As individuals struggled to sign up via poorly functioning online sites and health care carriers fretted about an adverse risk pool, brokers and consultants stepped in to find solutions.

“It’s creating a lot more work for us as consultants to make sure our clients are following all the laws, and making them aware of the taxes and additional costs to them,” said Kim Clark, an account director at Gallagher Benefit Services.

“I am hopeful that 2014 is easier than 2013,” she said. “I can’t imagine it getting harder than it was this past year.

“The carriers had to make changes to every single one of their plans for Jan. 1. Even if employers didn’t want to change their health plans, there were plan changes because of health care reform,” said Clark, a 2014 Power Broker® in the Employee Benefits category.

Transitioning Plans

A survey of health insurance brokers by Morgan Stanley found that quarterly-reported year-over-year rates in December 2013 were rising in excess of 6 percent in the small group market, and 9 percent in the individual market, according to an article in Forbes by Dr. Scott Gottlieb, a resident fellow at the American Enterprise Institute, a Washington think tank.

It is the largest reported increase since the firm started its quarterly surveys of brokers in 2010, he wrote. “Much of the rate increases are attributable to Obamacare.”

Thanks to Deb Mangels, senior vice president at ABD Insurance and Financial Services, the results were much more positive — and affordable — at the Piedmont Unified School District.

“It’s been an amazing year for us. We have transitioned our health care plans and it’s so much more than we have had,” said Michael Brady, assistant superintendent of the district, which employs more than 360 teachers, administrators and support staff in six schools near Oakland, Calif.

Mangels, a 2014 Public Sector Power Broker®, transitioned the district’s employee coverage from a health benefits pool with unsustainable cost increases to its own carrier at the same time the district was instituting its first medical benefits cap and increased premiums, following some “very intense labor negotiations,” Brady said.

“They reworked all of the plans,” negotiated a 15-month plan year so all plans would be on the same cycle, and added an online open enrollment tool. For the same benefits as the pool plan, the district’s employees pay about $100 less each month in premiums, he said.

Plus, employees have the option of choosing among some plan options related to copay and deductibles that were not available in the pool.

“I have never felt that we were in a better place than we are right now,” Brady said.

Communication is Key

When one HR director for an oil and gas drilling services company was holding employee meetings to discuss the introduction of a high-deductible plan, she faced resistance.

The materials she used to illustrate the changes were hampering her ability to clearly explain to employees and to foreign corporate parents the company’s new health benefit plans and options.

That’s when she called James Bernstein, a principal at Mercer and a 2014 Employee Benefits Power Broker® — at midnight that night. He’s the consultant she counts on to keep his eye on both the big picture and the gritty details necessary to keep her organization in compliance and on top of everything.

By the time she woke up in the morning, Bernstein had prepared and sent her a new set of PowerPoint slides that offered more clarity on the health benefit plans.

“I really couldn’t do this without him,” said the HR director. “I’ve got 10 balls in the air, and he will make sure I don’t drop one of them.”

Effective communication tools and strategies are a crucial part of plan design changes, said Robert Ditty, a partner at Mercer, and a 2014 Employee Benefits Power Broker®.

“You can design a plan until you are blue in the face but if people don’t understand it, you will not get the results you want,” he said.

Consumerism Takes Hold

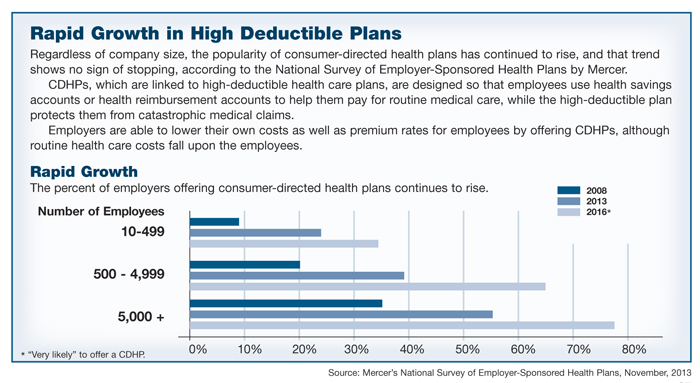

Many plan design changes took place this year with his clients, Ditty said, because employers needed to make changes due to the ACA anyway. As a result, they opted to move ahead with some strategic alternatives that had been under consideration for a while.

One popular option among his mid-size and large company clients was the transition to a high-deductible health plan, coupled with health savings accounts and health reimbursement accounts.

The health care reform law “made people re-evaluate … and it really expedited that strategy for a substantial portion of clients.”

Analyzing and strategizing around health benefits isn’t going to end any time soon.

Ditty’s clients are already trying to prepare for a substantial excise tax that kicks in in 2018. That tax — which requires employers to pay a 40 percent tax on health care costs that exceed federally defined thresholds — is better known as a penalty on so-called Cadillac plans. He said, however, that thresholds imposed for the federal tax will fall on “employers who are not offering very generous or rich plans.”

Instead, as the regulations are now written, they will affect many employers who have older workers and higher health care costs. “A significant portion of my clients are projected to hit this threshold in 2018, and they don’t have rich plans,” Ditty said.

That tax will join the other taxes imposed this year on employers. All of these developments have made life interesting of late for employee benefits consultants — “interesting,” as in the Chinese curse: “May you live in interesting times.”

Budgetary Concerns

It was those additional fees imposed this year that forced Gallagher’s Clark to seek out different health plan designs for her clients.

The ACA-imposed taxes — either directly borne by employers or probably passed along as increased premiums because they are paid by health insurers — are the Patient-Centered Outcomes Research Institute Fee (PCORI); a Marketplace User Fee that “could be almost 3 percent of their premium,” Clark said; a Transitional Reinsurance Program Assessment Fee; an Annual Health Insurance Industry Fee; and a Risk Adjustment Program and Fee.

Often, she said, employers had to change plan design “to help their budget to account for those additional costs.”

Also adding costs were some other requirements in the ACA, such as requiring pediatric dental benefits on all plans, even if the policyholders did not have children or their children were older than 18.

One other wrinkle in the ACA, which is playing out in the courts, is the need for all plans to include contraception benefits. That offered a unique challenge for Jan Wigen, a principal at Mercer, who was working with a religious institution.

The faith-based organization, a Catholic college, refused to pay for the benefit. Wigen, a 2014 Employee Benefits Power Broker®, helped the college secure separate contraceptive coverage through an insurer without having to pay for it, itself. She then provided separate enrollment cards and communication tools so the college could comply with the law and employees could have the coverage, without administrators breaking the dictates of their faith.

That was a regulation that had a fairly limited employer impact, but there was plenty of fodder in the ACA for angst to be created among employers of all sizes and shapes — and their brokers as well.

“I can’t think of an employer I talked to or worked with,” Ditty said, “where the law is not driving them in many instances to be more proactive about how they manage their benefit programs. … They have really become progressive in what they are doing from a strategic standpoint.”

For those employers lucky enough to have Power Brokers as their consultants, the process will run a bit smoother and the results will likely be a bit better, even as the demands on them increase and the regulations continue to change.