Workers' Comp

Making the Grade

Taking the time to match a tough job with a worker who can actually do it reduces the potential for costly workplace injuries, employers are now finding.

That concept is leading more employers to study their essential job functions and test the ability of job candidates, particularly when a job requires a new hire to perform functions known to cause injuries.

Increased nationwide hiring, the rising cost of treating workplace injuries and a less physically fit job applicant pool are driving more employers to employ the practice known as post-offer employment testing.

Post-offer employment testing, or POET, involves simulating the lifting, pushing, pulling and other physical activities that make up a job’s essential functions. Employers are increasingly making employment offers conditional upon a job applicant’s physical ability to perform those activities.

And in another recent trend, employers are expanding the strategy to help determine when to return an established employee to their duties following a workplace injury or a non-occupational disability leave.

“Pre-work screens are not a good strategy if your injuries are coming three years into employment.”

–Drew Bossen, founder, Atlas Ergonomics

At Cooper Standard, the Novi, Mich.-based automobile parts manufacturer, for example, workers desiring a strenuous job first participate in “simulated work.” That helps determine whether they are physically capable of performing the real job, said Patricia Hostine, the company’s global manager of workers’ compensation.

A job requiring continual force to press rubber hose into a mold that forms radiator hoses is desirable because it is one of the better paying tasks the auto parts manufacturer offers, Hostine added.

But it’s also one of the company’s most physically demanding roles.

“It’s very hard work,” Hostine said. “That is where a lot of our injuries are found.”

After performing the simulated work, more applicants decide against taking the job than the company disqualifies. That’s because the testing showed them they couldn’t do the job anyway.

Cooper Standard also requires a functional evaluation, conducted by physical therapists, for any worker who has been away from work either because of a workplace injury or a non-occupational disability.

That requires employees who normally form radiator hoses to show that they are once again physically capable of performing the work after returning from an absence.

Employers that have benefited from conducting POET evaluations for newly hired employees are increasingly adopting a similar worker evaluation as part of their return-to-work programs, several experts said.

“Historically, these [physical evaluations] have been used at the point of offer, at the point of employment,” said Drew Bossen, a physical therapist and founder of Atlas Ergonomics. “But in the last 12 months, we have clients formulating methodologies to use them for return to work as well.”

Data from an initial POET exam can also provide a measured baseline of an employee’s abilities that can be reviewed post injury to help determine when the worker has regained their ability to return to their original job, or whether they should take up other duties.

Using data that way can reduce return-to-work durations by providing support for a doctor’s determination to release their patient.

Most employers using a POET system, however, still use it only to test newly hired workers.

Evaluating whether potential new hires have the physical ability to perform certain tasks can substantially reduce a company’s injury rate because newer workers typically account for a greater number of injuries than their more-experienced counterparts, POET advocates said.

Data compiled by the National Council on Compensation Insurance Inc. showed that workers on the job less than a year in 2007 accounted for nearly 34 percent of injuries although they made up only 23 percent of the labor force.

“Pre-work screens are not a good strategy if your injuries are coming three years into employment,” Bossen said.

Now, as the U.S. Labor Department reports increased hiring across the country, vendors that provide physical ability testing programs said they are seeing increased demand, which had dropped off during the recession.

“We have seen a big uptick in companies interested in doing this across all industries,” including transportation, mining and health care, said Connie Vaughn-Miller, vice president of business development for BTE Technologies.

The testing may be more beneficial for the most strenuous types of work.

Hostine at Cooper Standard said, for example, that she does not see a cost/benefit advantage for testing workers engaged in light production jobs.

Most employers adopting a POET strategy do so for certain positions and many start with a pilot program, experts said. It’s best to decide which job categories to include in a pilot program by reviewing the company’s claims history to pinpoint where injury frequency and severity are problems. Or, they recommend starting with the company’s most physically demanding jobs, then add others if the pilot results warrant doing so.

“We can’t be a better place to work if we’re hiring people that are not able to perform the job. That’s bad for the company and the associate.”

–Libby Christman, vice president of risk management, Ahold USA.

Making Work Safer

“One of our company promises is to be a better place to work,” said Libby Christman, vice president of risk management at Ahold USA.

“We can’t be a better place to work if we’re hiring people that are not able to perform the job. That’s bad for the company and the associate.”

Ahold is a retailer with about 120,000 employees operating stores under the names of Stop & Shop, Giant Food Stores, Martin’s Food Markets, and Peapod, an online grocery ordering unit.

Late last year, Ahold launched a pilot program for Peapod delivery drivers and for certain strenuous jobs in two warehouses, Christman said. The warehouse jobs require pushing, pulling, bending and lifting.

Since September, Christman has found that about 25 percent of job applicants could not pass its physical demands test. Screening for an employee capable of doing the job, though, not only reduces injuries, but improves productivity.

“We know that obtaining an accurate assessment of an applicant’s physical abilities can help us place him or her in a suitable job, potentially eliminate injuries and ensure efficiency and performance on the job,” Christman said.

Stepped-up hiring is not the only factor driving employer demand for POET services, observers said.

Employers — continually pushing for more sophisticated safety measures in the face of an aging, more obese, and less physically fit U.S. workforce — are also driving the demand, BTE Technologies’ Vaughn-Miller said.

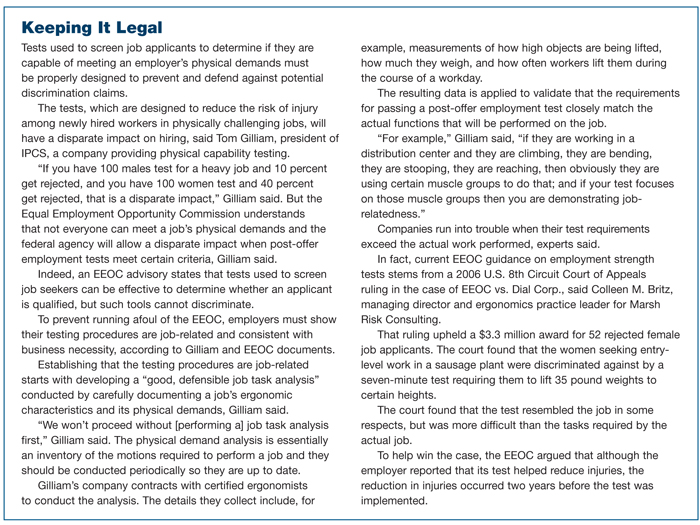

The Discrimination Question

Employers cannot discriminate when hiring, but they can legally ask a worker to demonstrate that they can meet the physical demands of a job’s essential functions, experts said.

That requires careful analysis, however, to clearly understand a job’s essential functions, so the designed test measures just those functions and does not go beyond evaluating a worker’s ability to perform those specific tasks.

Employers have run afoul of the Equal Employment Opportunity Commission when implementing POET programs that evaluated for abilities beyond those required by the job.

If employees must lift 75 pounds only once a year, and can use a mechanical lift assist to help them when they do so, then testing to see whether a worker can lift 75 pounds is not a fair test, advised Colleen M. Britz, managing director and ergonomics practice leader for Marsh Risk Consulting.

Employers may also face discrimination complaints if they do not require a POET evaluation of everyone seeking a specific job, experts warned.

The tests themselves, however, vary substantially, depending on the vendor or employer providing them.

Some resemble gym equipment with electronic systems for measuring a worker’s strength and agility. Those results can then be compared to computerized measurements of a task. Other tests may be as simple as requiring a worker to lift bags of sand.

“I do consider it a best practice to have a well-designed post-offer employment test that truly is measuring an employee’s capacity to meet physical demands,” Britz said. “It’s a matter, from my perspective, of whether some of the methodologies are truly testing that.”

The wide variation in testing methodology has hampered the collection of data on POET’s impact on overall employee injury rates across industries or multiple employers, experts said.

But individual employers have experienced success, Britz said.

“I don’t know of any company that has stopped doing POET after starting — because they are seeing a positive return on investment,” she added.

A physical abilities test helped Prince William County in Virginia mitigate a double loss driven by candidates seeking to become firefighters.

The county was losing tens of thousands of dollars on hiring and training costs each time a job candidate washed out of a 26-week training course simply because they could not perform the physical challenges firefighters face in the line of duty, said Tim Keen, assistant chief for the county’s Department of Fire and Rescue.

Because firefighting is a tough job, a lack of physical capability also contributed to recruit training injuries.

“Not only is it a hard job, but when you add all the gear they wear, their air packs, as well as the functional movements that it takes to accomplish certain tasks, it puts strains on the body,” Keen said.

Those strains became costly workers’ compensation claims when recruits could not return to an existing job as would occur after an established firefighter suffered an injury, added Lori Gray, the county’s risk management division chief. That forced the county to continue paying workers’ compensation benefits to recruits who did not have a job to return to.

So in 2003, the risk management and fire department helped the county establish its own facility where applicants wanting to become firefighters must first participate in a standardized Candidate Physical Ability Test.

The International Association of Fire Fighters and the International Association of Fire Chiefs developed the CPAT test the county licenses.

The test used by fire departments across the country requires candidates to climb stairs while wearing weight vests, drag hoses and simulated bodies, simulate forcing their way into a building, and conduct other physical feats within a certain time period.

“There are a variety of firefighting tasks they must go through in this course,” Keen said. The course tests their aerobic capabilities, their flexibility, core strength, and upper and lower body fitness.

The test’s standardization ensures it is true to the firefighter’s actual work role and that is legal and fair to all candidates, he added.

“Regardless of age or gender the course is the same for everybody,” he said.

“The test is appropriate so you are not losing people due to injuries, especially early in their careers, Keen said. “It’s the right thing to do, making sure they are physically capable of doing the job.”

The screenings have resulted in fewer recruits lost due to a lack of physical ability.

“We have also seen a huge reduction in the number of injuries that were occurring because recruits are coming in more physically fit to do the job,” Keen said.

POET advocates said the screening results have other applications as well.

In some cases, post-offer physical test results provide employers with a defense in permanent disability cases, Britz said.

In states allowing employers to apportion responsibility for permanent disability claims, for example, the baseline results from the initial post-offer exam can limit an employer’s liability by showing that a worker lost only a certain portion of their functional ability during their employment tenure.

Britz added that she expects to see more large, sophisticated employers counter rising claims severity driven by factors such as aging and obesity by integrating their ergonomics, wellness intervention and physical ability testing programs.

For example, an employee returning from a leave might undergo a fitness for duty exam to evaluate their ability to perform the job without injuring themselves.

Simultaneously, the employee could be referred to the employer’s wellness program to address health-related issues such as high body mass index or to learn exercises that would strengthen certain body parts, such as their shoulders, if frequently used in their daily work routines.

“That is the evolution of post-offer employment testing into fitness-for-duty programs,” she said.

“Not so they lose the job, but to recognize that this person needs to work on shoulder strength. So we create an opportunity to increase shoulder strength. I think that is going to be the wave of the future.”