Sponsored Content by Helios

A Tale of Two Physicians

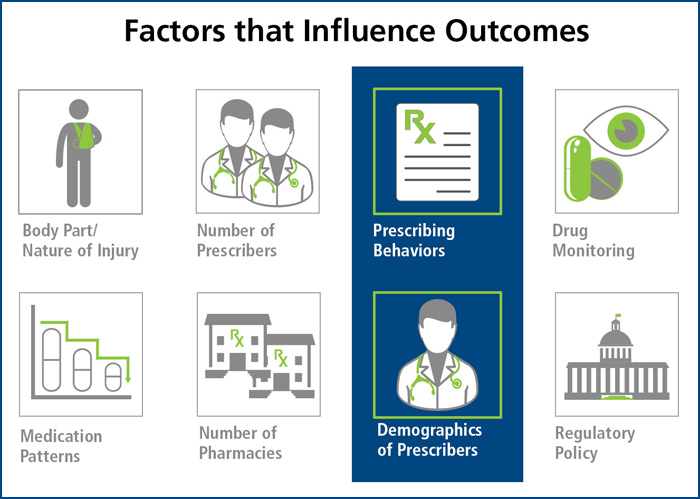

There are many factors that influence the outcome of a workers’ compensation claim. Some, such as the body part and nature of injury, come as no surprise. Similarly, the state of jurisdiction and associated regulatory requirements are long-recognized as having an impact. One might not consider however, the role of the prescribing physician and how their demographics and behaviors influence outcomes.

To illustrate this, here is a tale of two physicians, Physician A and Physician B. Both are committed to caring for their patients but have markedly different work environments and practice structures that influence their prescribing behaviors.

Physician A

Physician A treats workers’ compensation patients in a big city. She is well-known and well-respected in the community and has a thriving practice. Physician A is employed by the local hospital and she supplements her salary by performing some in-office, minor procedures, such as skin biopsies and steroid injections for achy shoulders. She belongs to an accountable care organization (ACO) that has quality metrics in place to help its providers follow evidence-based medicine and best practice treatment models. These quality metrics, if met, result in some shared savings that are passed on to physicians as a financial reward for better outcomes.

Physician A treats workers’ compensation patients in a big city. She is well-known and well-respected in the community and has a thriving practice. Physician A is employed by the local hospital and she supplements her salary by performing some in-office, minor procedures, such as skin biopsies and steroid injections for achy shoulders. She belongs to an accountable care organization (ACO) that has quality metrics in place to help its providers follow evidence-based medicine and best practice treatment models. These quality metrics, if met, result in some shared savings that are passed on to physicians as a financial reward for better outcomes.

Physician B

Physician B sees patients in a rural setting in his own, private practice. For him, the efficiency at which he can see patients determines whether or not he will meet his overhead each month. His nurse fields as many patient questions as possible in advance, and he does a quick exam and writes a prescription. Physician B feels constantly inundated with the increasing changes in healthcare and technology. He has tried to incorporate evidence-based guidelines into his practice but, with everything else on his plate, he is frustrated at the mere thought of keeping up with the constantly expanding medical research. To supplement his income, he works with a physician dispensing company and speaks on behalf of pharmaceutical companies.

Physician B sees patients in a rural setting in his own, private practice. For him, the efficiency at which he can see patients determines whether or not he will meet his overhead each month. His nurse fields as many patient questions as possible in advance, and he does a quick exam and writes a prescription. Physician B feels constantly inundated with the increasing changes in healthcare and technology. He has tried to incorporate evidence-based guidelines into his practice but, with everything else on his plate, he is frustrated at the mere thought of keeping up with the constantly expanding medical research. To supplement his income, he works with a physician dispensing company and speaks on behalf of pharmaceutical companies.

Two Patients

A claims professional, in the process of working her caseload, discovers that Physician A’s patient is taking large doses of opioid medications yet has never had any urine drug screens or other documented opioid monitoring. Physician B’s patient was identified by the PBM’s early intervention program as requiring further review. Physician B’s patient is seeing multiple physicians, filling prescriptions at multiple pharmacies, and has a high-risk of long-term opioid use and a high likelihood of prolonged claim duration.

PBM Intervention

Both physicians receive correspondence from the PBM requesting a Peer-to-Peer medication review. In addition to including all requisite patient information, the letter is courteous and professional, relaying the objective of speaking directly with the prescribing physician in order to discuss the findings and recommendations.

Two Very Different Reactions

Upon receiving the reviewing physician’s phone call, Physician A was appreciative and freely commented that she had missed opportunities to apply opioid monitoring strategies provided by the PBM. She also agreed to convert the claimant’s antacid to an over-the-counter version. The reviewing physician completed a report detailing his conversation with Physician A and submitted copies to her, the claimant’s insurer, the PBM, and the claims specialist. The agreed-upon changes took effect on the next refill.

In contrast, it took several calls from the reviewing physician to convince Physician B’s receptionist to let him speak with Physician B. At first, Physician B was quiet and did not offer much feedback to the recommendations provided by the reviewing physician. He was irritated by the request to switch the claimant’s brand medications to generic, interpreting this request and the entire call to be solely focused on cost savings. Once discussion about the claimant’s opioids began, Physician B couldn’t contain his anger, declaring, “This is my patient! You have never even seen this patient before, so who are you to tell me how to manage his pain?”

Having anticipated such a possible reaction, the reviewing physician calmly deescalated the conversation with careful and sensitive language to reassure Physician B that the recommendations are entirely rooted on evidence-based guidelines and that the control of the patient’s pain remains a priority. The reviewing physician was able to refer to alternative dosing schedules and non-opioid treatment options to address the patient’s neuropathic pain. He also pointed out that the medications being prescribed for insomnia could interact with the claimant’s pain medications, possibly resulting in over sedation and death.

By the end of the call, Physician B realized that he had indeed overlooked some of the medication interactions and opportunities to more effectively manage the claimant’s pain without the use of opioid analgesics. He did not verbalize this realization, but agreed to make some changes to the medication regimen. He was still reluctant to change the claimant’s antacid to an over-the-counter version, citing his experience that they are not as effective as those dispensed by pharmacies. A few months later, the PBM performed a retrospective review; the medication therapy had changed – except for the antacid.

The Result

While traveling different paths, both physicians responded favorably to the Peer-to-Peer intervention.

By understanding the challenges some physicians are facing and the impact they can have on prescribing behaviors, payers can be better equipped to engage physicians in cooperative care management. A collaborative approach emphasizing the patient’s safety can enhance the physician’s willingness to compromise with medication therapy recommendations. In the end, the result is a better outcome for the payer, physician, and injured worker.