Global Risk

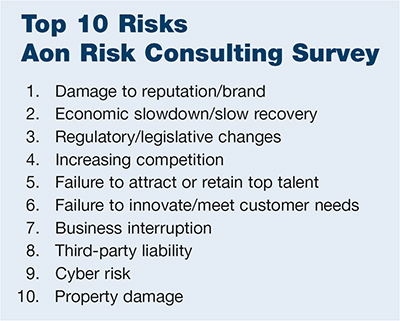

Top Risks Ranked by Risk Managers

The global risk landscape is so rich with exposure that it’s not surprising that two recent surveys show divergent worries by risk managers.

In a recent study of 1,400 global CEOs and risk managers by Aon, damage to reputation and brand was the clear-cut No. 1 choice.

A Clements Worldwide survey of risk executives at global organizations and NGOs, on the other hand, cited political risk as their No. 1 concern.

A Clements Worldwide survey of risk executives at global organizations and NGOs, on the other hand, cited political risk as their No. 1 concern.

“I think it’s a combination of things but when you think about all of the other risks that are there, damage to reputation and brand is really the culmination of the connectivity of all different kinds of risks,” said Baltimore-based Theresa Bourdon, group managing director at Aon Risk Consulting.

“So any one of the other risks, if a company is not prepared for them, is going to affect their reputation and brand,” said Bourdon. “It’s kind of where it all collects right at the top of the brand of the organization.”

The uncertainty and unrest overseas obviously made a major impact on the global respondents of the Clements survey.

“There are many, many companies which are either contemplating or have already engaged in opening operations overseas, and that’s happening across all industries,” said Scott Lockman, Washington, D.C.- based director of commercial insurance at Clements.

More than one-quarter (28 percent) of top managers surveyed by Clements stated that political unrest was their top concern, while 25 percent cited kidnapping and 10 percent cited terrorism.

Twenty-one percent said they delayed plans to expand into new countries due to rising international risks.

Lockman said that when the organization speaks with its clients about civil unrest, it doesn’t necessarily have to be about a physical threat.

“A devaluation of a currency can cripple a business, like what’s happening in Venezuela, for example.” — Scott Lockman, director of commercial insurance, Clements Worldwide

“A devaluation of a currency can cripple a business, like what’s happening in Venezuela, for example,” he said. “Their economy is in turmoil right now.”

More than half of the 52 Clements survey respondents (57 percent) reported increased spending on international insurance, while 44 percent reported increased spending on risk management overall.

More than half of the 52 Clements survey respondents (57 percent) reported increased spending on international insurance, while 44 percent reported increased spending on risk management overall.

“Specifically we have seen spending on political violence insurance go up 20 percent over the past couple of years,” said Washington, D.C.-based Patricia Loria, Clements’ marketing communications manager.

Meanwhile, in this year’s Aon study, political risk dropped out of the Top 10 list.

“It was No. 10 the last time we did the study in 2013 and now it’s down to No. 14,” Bourdon said. “Political risk is one of the risks we don’t think is getting the attention it deserves.”

The global economic slowdown was No. 1 in the 2013 study; it dropped to No. 2 this year, she said.

As for cyber risk, Bourdon said she was surprised to learn that 82 percent of the respondents — who ranked cyber risk in the Top 10 (at No. 9) for the first time after being No. 18 in 2013 — said they were ready for the risk and only 8 percent said they had a loss of income as a result of a cyber attack.

Another surprise for Bourdon was the threat of terrorism. “We were very surprised that it was very low on the list,” she said. “There is sort of an out of sight, out of mind mentality here.”

Also out of mind, she said, was pandemic risk, which ranked at No. 44.

“We haven’t seen regulations decreasing, we’ve only seen them increasing.” — Theresa Bourdon, group managing director, Aon Risk Consulting

One perennial concern, Bourdon said, is regulatory risk, which usually ranks as a Top 5 risk.

“We haven’t seen regulations decreasing, we’ve only seen them increasing,” she said. “You look at the global economic expansion. That’s brought additional regulations.”

Bourdon noted that Aon’s respondents were also very concerned about the impact of catastrophic property damage, such as from a hurricane or large fire.

Property damage and medical expenses represented the largest sources of financial losses among respondents to the Clements survey.